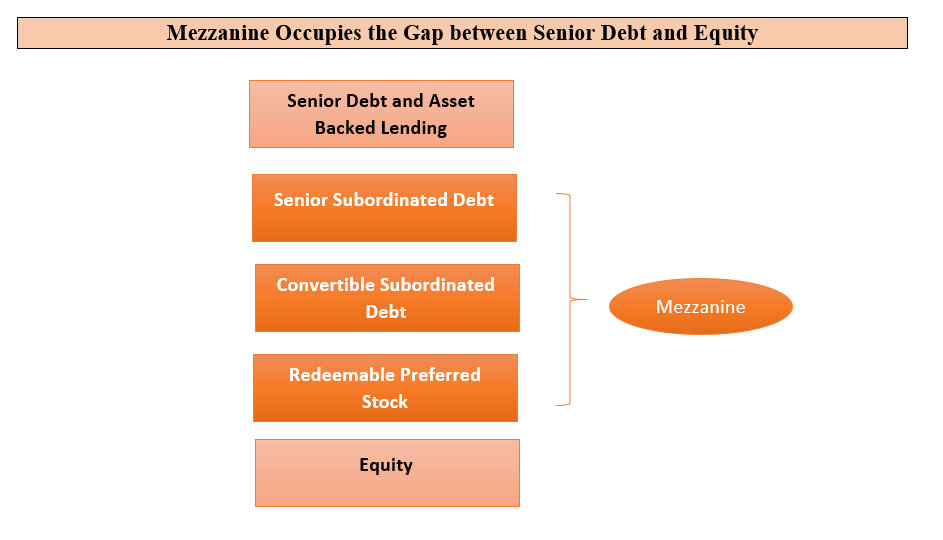

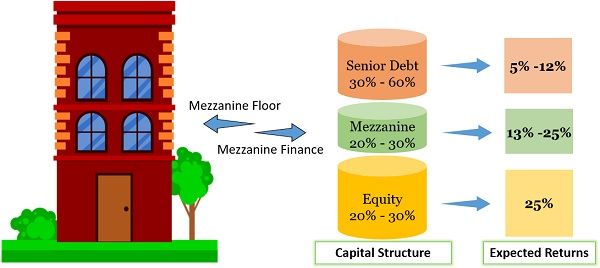

Sustainability | Free Full-Text | Balancing Project Financing and Mezzanine Project Financing with Option Value to Mitigate Sponsor's Risks for Overseas Investment Projects

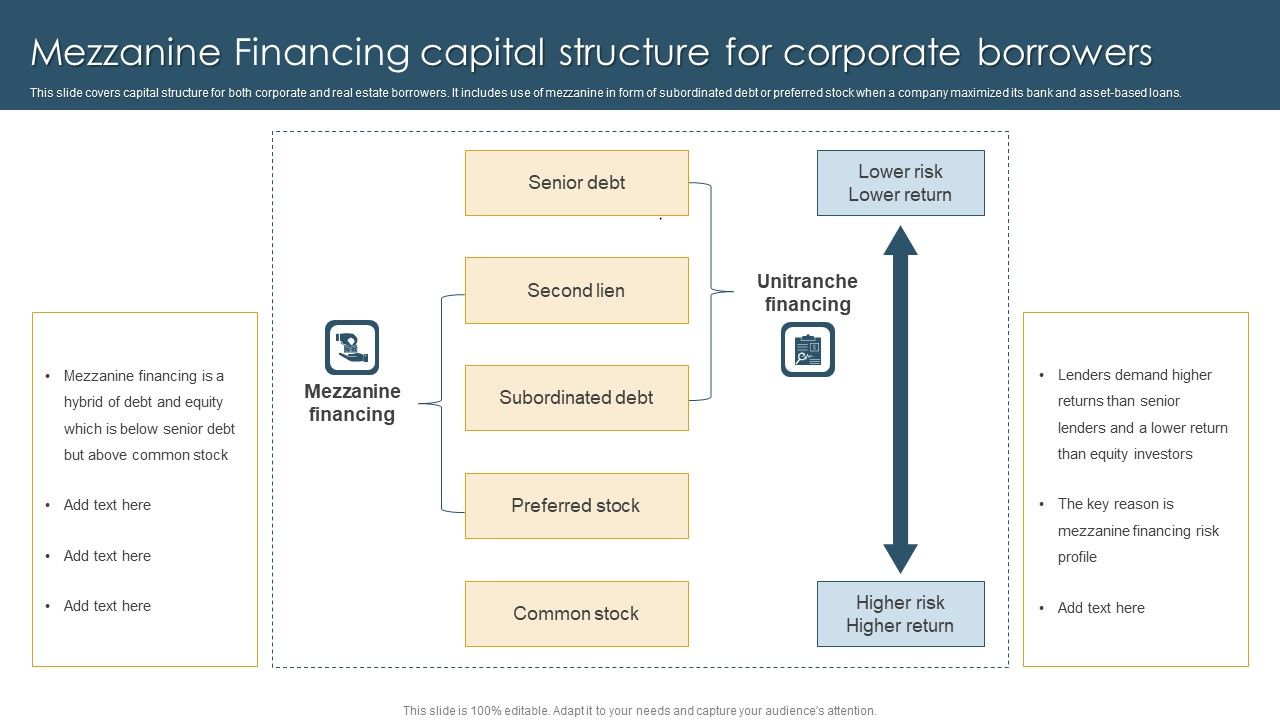

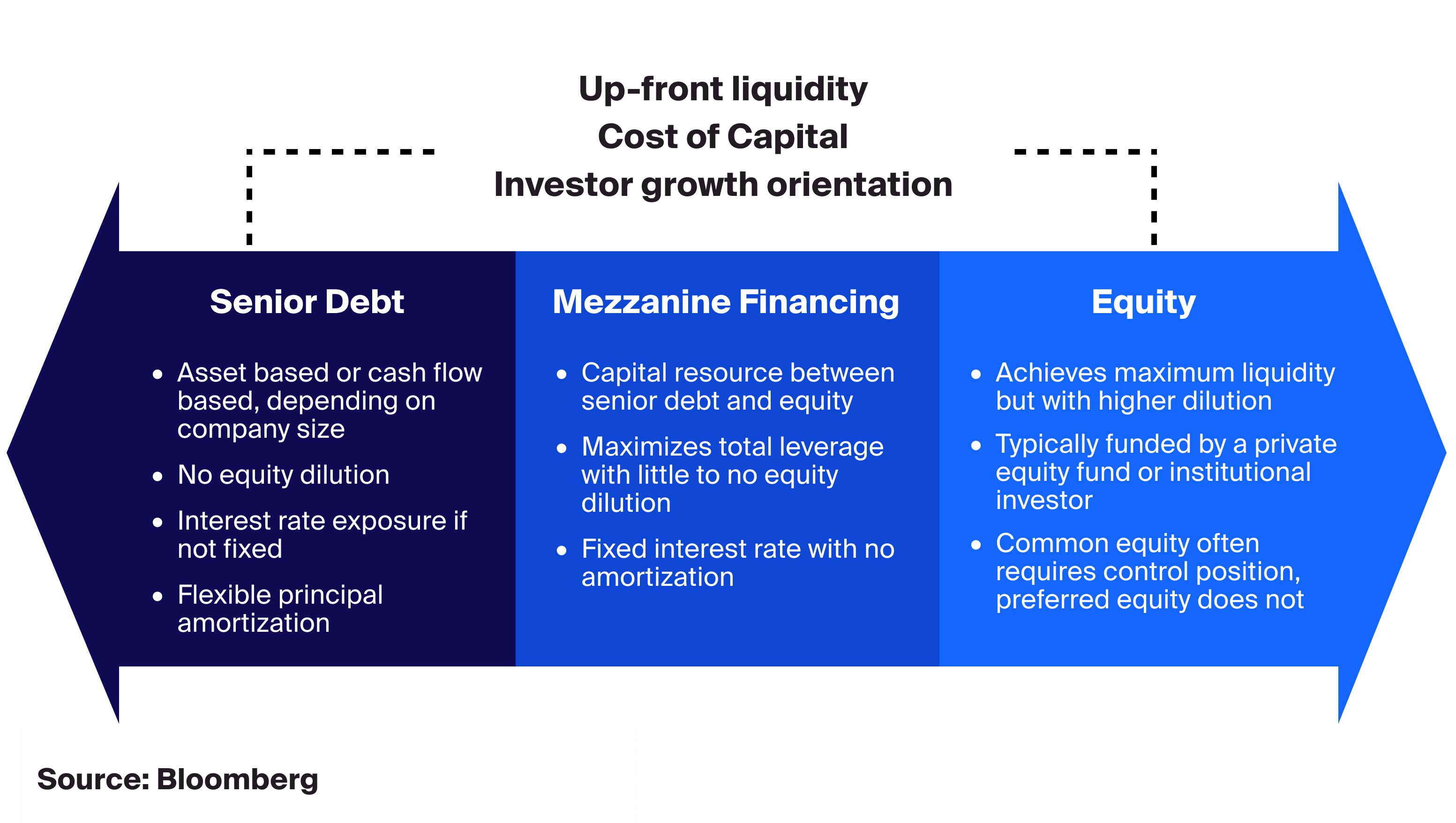

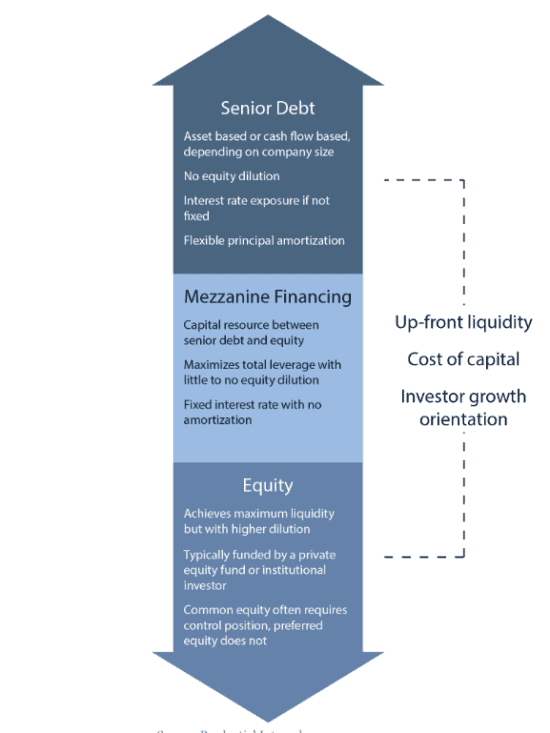

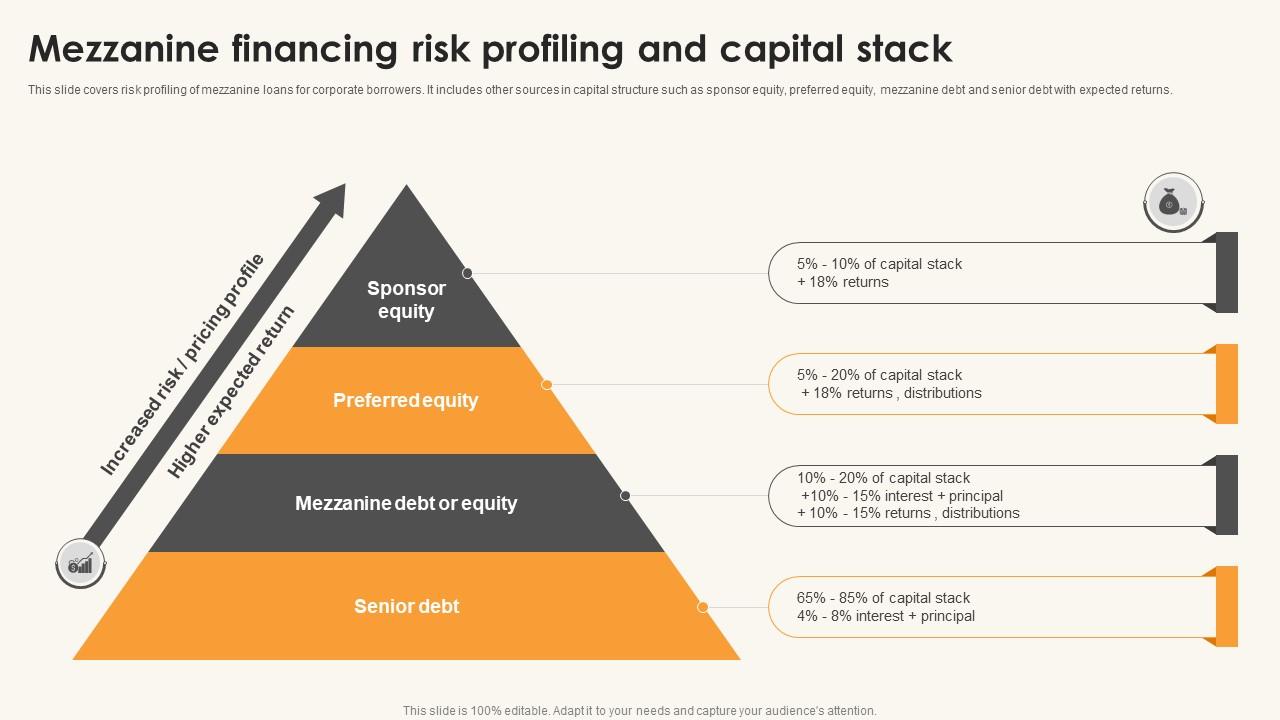

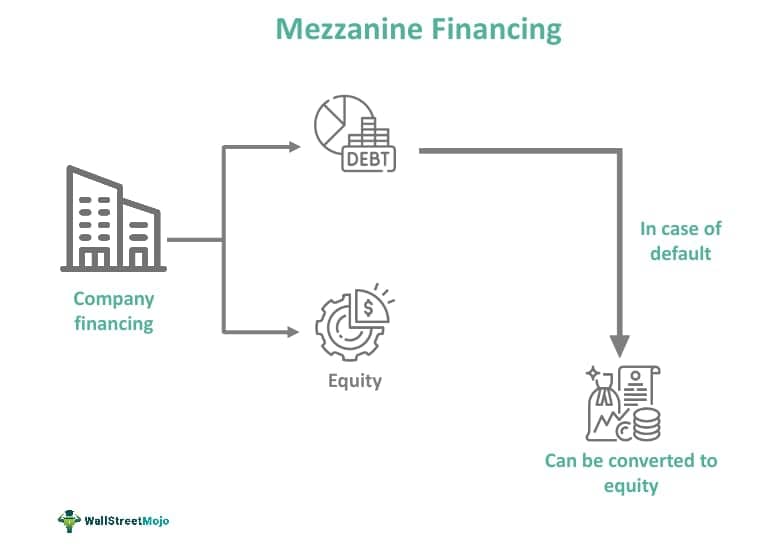

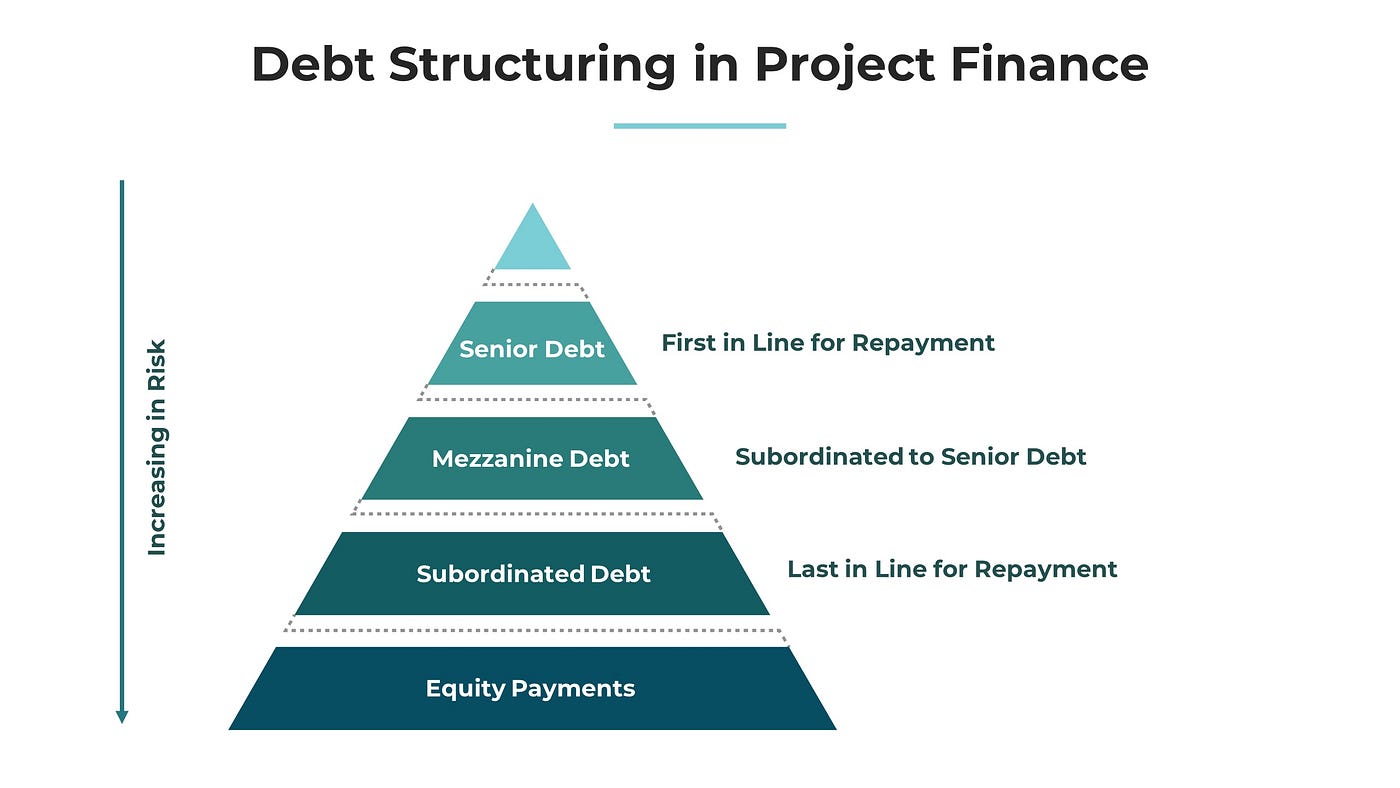

Debt Structuring in Project Finance: Balancing Risk and Returns for Successful Infrastructure Development | by Matthew Bernath | Medium

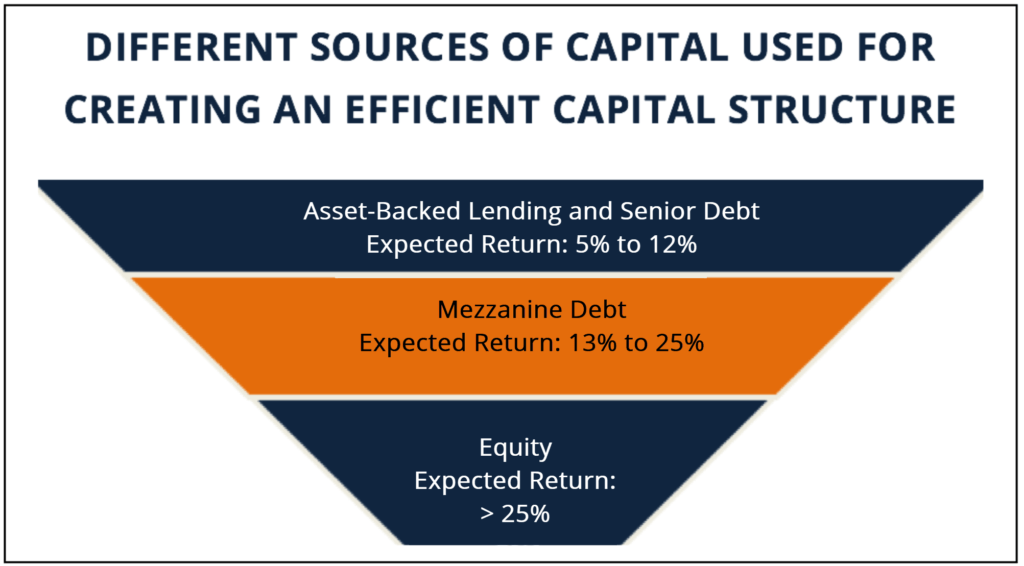

Gary Miller: Know what capital structure is and how to use it to grow your business – The Denver Post

Debt Structuring in Project Finance: Balancing Risk and Returns for Successful Infrastructure Development | by Matthew Bernath | Medium

Optimization of Capital Structure for Urban Water PPP Projects Using Mezzanine Financing: Sustainable Perspective | Journal of Construction Engineering and Management | Vol 149, No 8